Dharmaj Crop Guard Ltd is an Ahmedabad-based company incorporated in 2015, engaged in the business of manufacturing, distributing, and marketing a wide range of agrochemical formulations such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilizers, and antibiotics to the B2C and B2B customers.

Further, it provides farmers with crop protection solutions to help them increase production and profitability. It also conducts training programs with them.

It exports its products to more than 20 countries in Latin America, the Middle East, East African countries, and far East Asia. The company’s branded products are sold in 12 states through a network comprising over 3700 dealers having access to 8 stock depots in India.

The company’s production facility is located in Ahmedabad, Gujarat, India. They also have a research and development (R&D) facility in the plant itself.

The company has 392 registrations for agrochemicals from the CIB and RC. Out of this 191 Agrochemical formulations are exclusively for exports.

They have over 150 trademark registrations including its own Branded products.

Read More: How to apply for an IPO in India [A complete guide]

Dharmaj Crop Guard IPO Details

| Issue opens | Nov 28, 2022 |

| Issue closes | Nov 30, 2022 |

| Lot size | 60 Shares |

| Price band | Rs. 216 – Rs. 237 per Share. |

| Shares allotment date | Dec 5, 2022 |

| Credit of Shares to Demat | Dec 6, 2022 |

| IPO listing date | Dec 8, 2022 |

| Issue Size | 251 cr |

Dharmaj Crop Guard IPO Promoter Holding

| Pre Issue Share Holding | 100% |

| Post Issue Share Holding | 73.03% |

Company’s Key Customers:

Atul Ltd.

Heranba Industries Ltd.

Innovative Agritech Pvt Ltd.

Meghmani Industries Ltd.

Bharat Rasayan Ltd.

United Insecticides Pvt Ltd.

Sadik Agrochemicals Co. Ltd.

Objectives of the Issue:

| Rs. 105 Cr will be used for setting up a manufacturing facility at Saykha, Bharuch, Gujarat – this will increase their production capacity as they have only 1 plant for manufacturing. |

| Rs. 45cr will be used for the working capital requirement. |

| Rs. 10 cr will be used for repayment or prepayment of debts – this will reduce its interest cost which will have a positive effect on its PAT. |

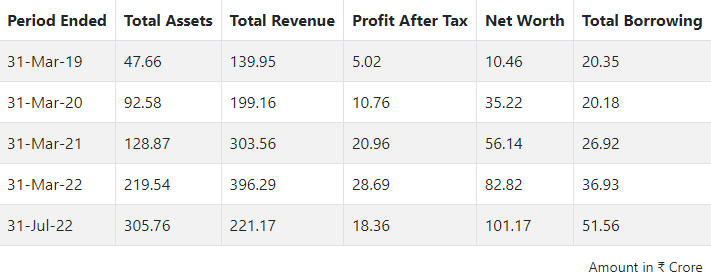

Dharmaj Crop Guard Ltd Financials

| Asset growth is 360% from March 2019 to March 2022. |

| Sales growth is 183% from March 2019 to March 2022. |

| PAT doubles every year. From March 2019 to March 2022, it has grown almost to 691%. |

From the financials, it can be concluded that the company is still in a growing stage and has a lot of potential ahead. The only negative point in financials is borrowings are increasing year on year which will have a negative impact on PAT as the interest amount will be paid by the company.

Strengths:

- Dharmaj Crop has a diversified portfolio of products such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilisers and antibiotics. This diversification insulates its business operations from risk. Even, if one of its products does not work in future, it will not make much difference to the business.

- The company exported its products to 60 customers across 20 countries.

- The company has a strong distribution network having 3,700 dealers with access to 8 stock depots in India.

Weaknesses:

- Business is subject to climatic conditions and cyclical in nature as the agrochemical industry is weather-sensitive.

- They operate with fewer margins as we can see with a revenue of 396 Cr in 2022, PAT is just 28.69 crores, a margin of only 7%.

- Government policies and subsidies can affect this business. Reduced government support for agriculture, modifications to the incentives and subsidies given to farmers, restrictions on crop exports etc. can reduce the company’s profitability.

Conclusion:

The financials of Dharmaj Crop Guard are very sound. The company is growing at a massive rate. Retail investors can apply for this IPO because the issue size is small and will definitely be oversubscribed. On the very first day of opening, Dharmaj Crop IPO is subscribed to 2.6 times in retail category.

Note– This is my personal opinion on Dharmaj Crop IPO. Before applying for IPO do take financial advice from your advisor.