Here in this article, I will discuss step by step guide on how to apply for an IPO in India through the Zerodha application.

Before moving directly to how to apply for an IPO, let us understand what an IPO is and why companies issue it.

What is an IPO and why do companies issue their IPOs?

An Initial Public Offering, or IPO, is the process of publicizing a privately held company. When a business is privately owned, it is 100% owned by its owners or stakeholders, and when they decide to take it public, they approach stock exchanges like NSE or BSE for their company listing.

It is the method that a company uses to raise funds through the market, as businesses require funds for a number of reasons like capacity expansion, repayment of loans, capturing the opportunity in different business areas, etc.

An initial public offer (IPO) allows us to acquire shares from a company that is going public. This medium is a popular investment option because it offers the possibility of rapid growth.

Ujjivan Bank IPO, IRCTC, and Paras Defence are good examples. Ujjivan bank was subscribed 165.66 times.

It means there was more demand for the shares it issued. For this, you have to be very lucky to be in the top 1%

Common Myths regarding IPOs.

The first wrong information about IPO is that it can make you rich overnight. It does not happen; the reasons are:

Myth 1: You cannot invest as much money as you want in IPO, like in shares where we can buy any number of shares. For example, we can buy TCS shares for Rs 1 lakh, 2 lakhs, or as much as we want, but IPOs are available in lots.

so we cannot apply more than that. Even if you got 1 lot (approx. value 12-15 thousand), it means you bought shares worth 15k.

If you get 2-3 times the listing gain, even then maximum money you earned is 30k or 45k. So IPOs are not a shortcut to getting rich; get this thing out of your mind.

Note – you can invest a maximum of 2 lakh rupees in IPO, but it depends on your luck how many lots you get. For e.g., if You applied for 10 lots worth Rs 2 lakhs, but you got only 3, then your maximum investment would be Rs. 60k.

Myth 2: It does not happen in IPO that if you apply on the first day, you have more chances of getting allotted. It depends totally on your luck whether you get allotted or not.

How to select an IPO

If you wish to apply for an IPO keep these points in mind before applying:

Most of the IPOs are overvalued because companies are selling their stake in it and they want to get maximum money for this thing. If the value of their share is 100 rs then they ask for 150 or 200.

But Some IPOs are fairly priced because they are brought under some pressure like RBI regulations or government pressure eg. small finance banks, BSE, etc.

Government IPOs are normally fair valued because the government does not want its image as a looter who is looting public money.

IPO usually opens for 3-4 days, so never apply on the first and second day, apply only on the last day, it gives you an idea about the subscription rate i.e. how much it is subscribed.

The IPOs which get heavily subscribed in the first 2 days are guaranteed to generate high listing gains.

Requirements for IPO application:

A few things are required to apply for an IPO:

- You must have a Demat account and trading account ( if you want to sell shares on the listing day itself, otherwise only a Demat account is sufficient). You can open your Demat account with stock brokers like Zerodha, Upstox, 5 paise, Angel one, etc.

- A Permanent Account Number i.e. PAN

- A bank saving or current account linked with your Demat account.

- Your bank account must have enough balance to fund your application and When you apply for an IPO, the amount does not get deducted immediately from your account, but it remains locked until the date of allotment.

If you are not able to get your IPO allotment, then the block money will be released again to your account.

How to apply for an IPO in Zerodha [step-by-step guide]

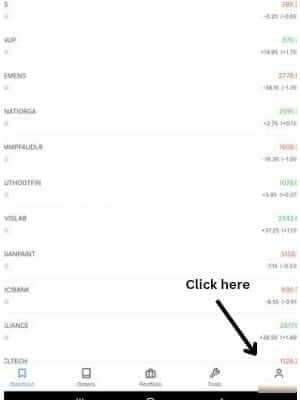

- Login to your Kite mobile app.

- Click on the profile picture icon- from there click on IPO

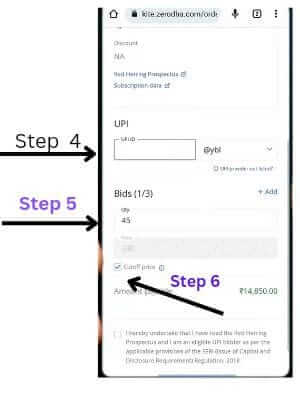

- Click on “Bid” then a new window will get open

- Then add your UPI Id (here you can use any UPI id either of Phonepe, Paytm, Gpay, etc.) and verify it.

- In the Quantity option- add a number of shares, eg. If you want to purchase only one lot and it has 15 shares in it then add 15 in quantity. For 2 lots add 30 in quantity.

- Always click on the cutoff price, this will increase your chance of allotment. After you click on the cutoff price then no need to fill in the price column.

- Then click the checkbox and submit.

From here payment approval notification will go to your UPI app (Paytm, phone pay, etc. You need to approve the payment transaction by going into the app and your bid will be approved by the exchange.

How to apply for an IPO in India – FAQ

Q1. Time to apply for an IPO?

Ans. IPO orders can be placed anytime between 10 AM on the issue opening day and 4:30 PM on the issue closing day.

Q2. Can I modify or cancel my IPO application?

Ans. Yes, you can modify or cancel your IPO application till the time IPO is open for bidding.

Q3. Can I apply for an IPO from my 2 Demat accounts?

Ans. No. you cannot apply from your different Demat accounts with the same PAN. But you can apply from your relatives’ Demat account to increase your chances of allotment.

For Daily Swing Trades, Kindly follow my Instagram Page:- Compounding Charts